Breakthrough Belief #2 = You make the profit on the first close, not the second!

The ah-ha moment for me in real estate was finally realizing that you make your money as much-- if not MORE-- on the purchase of the property rather than the sale of the property.

(And this is the opposite of what most flippers think.)

Leads me to this...

👇

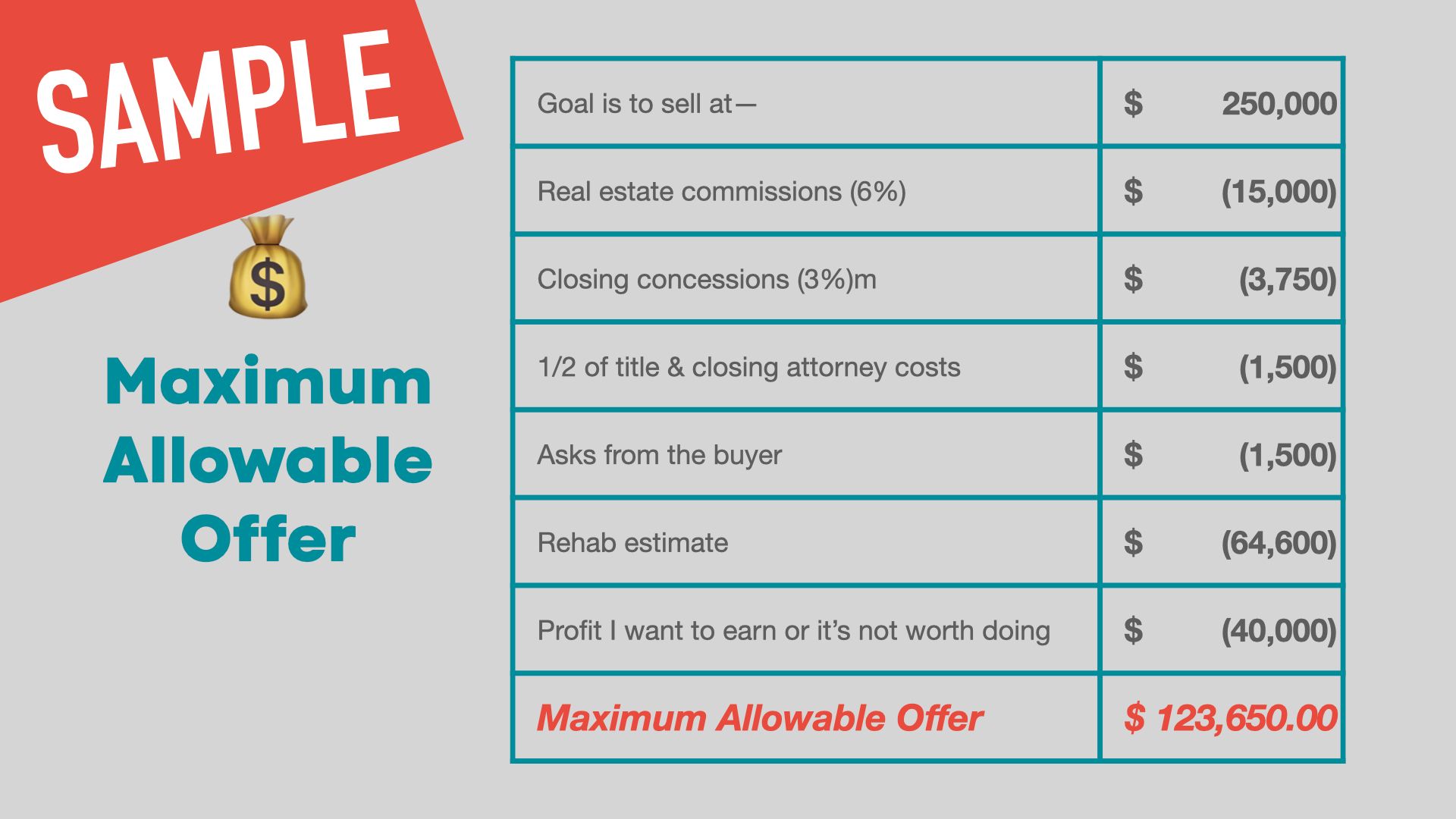

You need to know the MAXIMUM ALLOWABLE OFFER (MAO), so you can account for all of the variables.

Three things to know about the MAO--

1️⃣ It's almost ALWAYS lower than you think (hint: most investors spend too much on the property)

2️⃣ It's easy to let your emotions get involved (hint: you must be willing to walk away from what looks like a "good deal")

3️⃣ It's THE thing that sets you on the correct or incorrect course from the start (hint: the first closing when you acquire is often MORE important than the second closing when you sell it)

This approach is counter-intuitive to how most people approach their deals.

They think--

📌 Find a house

🪚 Fix the house up, make it look nice

🚚 Flip it and make a dump truck full of money

But, there are other factors.

It's all easy to navigate (and stay profitable from the start) if you have the right tools (read: simple spreadsheets and easy-to-figure formulas in hand).

The MAXIMUM ALLOWABLE OFFER (MAO) always includes--

💰Commissions for agents (trust, they'll list the house and sell it faster than you ever will on your own, and they'll save you money on pictures, wasted time, etc.)

💼 Closing costs and attorneys fees

⁉️ Concessions the buy will ask for...

🛠️ Construction, rehab, and renovation costs

💩 Contingencies and emergencies (go ahead and factor them in-- especially in a rehab). If you don't need the money, then that's more profit for you.

🏦 Cash you want to make and put in your bank when the deal is done (yes, you need to budget this on the front end to see if it's even a good deal and worth doing)

Follow the example here. Once you "see it," you can't unsee it...

And you'll discover why...

If you follow our process NOT ONLY will you NOT drag out the timeline (and lose money) or do things out of order (costing you even MORE money), you'll never overpay for a property.

It all has to do with the "MAO."